Navigating the World of Tax and Accounting

with Nona Tax Avalon Park:

Essential Insights for Businesses

In today’s complex financial landscape, businesses must prioritize effective tax and accounting practices to ensure compliance, financial stability, and growth. Whether you’re a small startup or a large corporation, managing taxes and financial records efficiently is crucial for long-term success.

The Importance of Tax Compliance

Tax compliance is a fundamental responsibility for all businesses. Failing to meet tax obligations can lead to penalties, legal issues, and damage to a company’s reputation. Businesses must stay informed about tax laws, filing deadlines, and deductible expenses to maximize savings and avoid unnecessary costs. Consulting with a tax professional or accountant can help navigate these regulations and optimize tax strategies.

Bookkeeping and Financial Management

Accurate bookkeeping is the backbone of any successful business. Keeping detailed financial records helps track income, expenses, and cash flow, enabling better decision-making. Businesses should invest in reliable accounting software or hire a professional accountant to maintain financial statements, reconcile accounts, and generate reports for strategic planning.

Tax Planning Strategies

Proactive tax planning can significantly reduce a company’s tax burden. Businesses should explore deductions, credits, and tax-efficient structures to maximize savings. Common strategies include:

- Claiming business expenses such as office supplies, travel, and equipment

- Utilizing depreciation benefits for assets

- Taking advantage of tax credits for research and development or hiring incentives

- Structuring business operations to minimize taxable income legally

The Role of an Accountant

An experienced accountant provides valuable insights beyond tax preparation. They can assist with financial forecasting, budgeting, and regulatory compliance. For businesses facing audits or financial challenges, accountants can help develop strategies to mitigate risks and improve financial performance.

Adopting Technology in Accounting

With advancements in technology, businesses can streamline accounting processes using cloud-based software, automation, and AI-driven analytics. Digital solutions help reduce human error, improve efficiency, and provide real-time financial insights, allowing business owners to focus on growth and innovation.

Key Takeaways

Managing taxes and accounting effectively is essential for the success of any business. Staying compliant, maintaining accurate records, and leveraging professional expertise can help businesses optimize their financial health. By adopting modern accounting practices and tax strategies, businesses can ensure long-term stability and profitability.

Nona Tax Avalon Park can help you achieve your personal and business financial health.

Nona Tax Avalon Park

12001 Avalon Lake Dr, Suite L

Orlando, FL 32828

(407) 583-6688

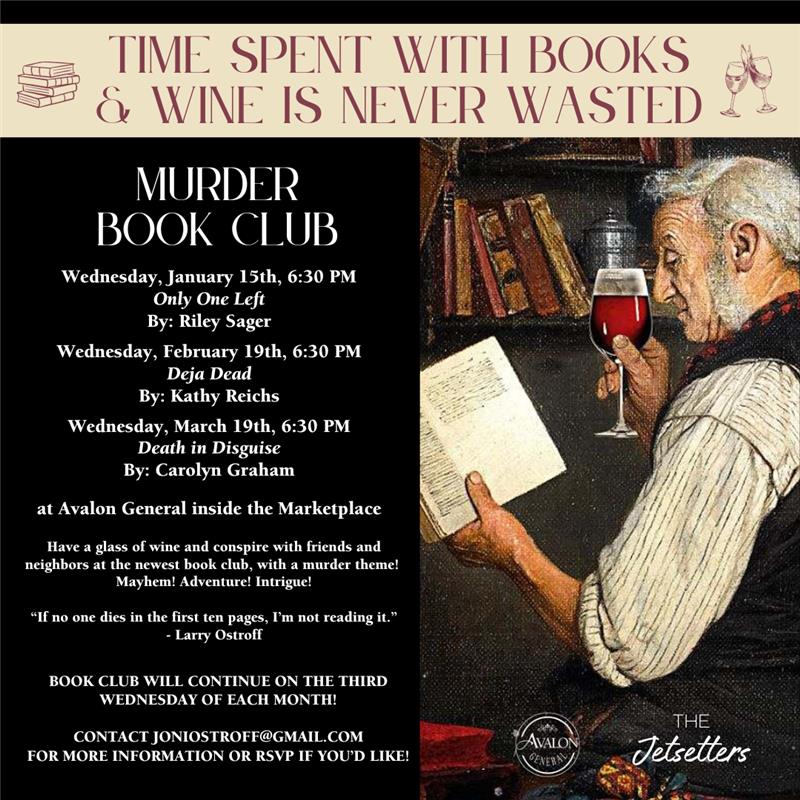

Don’t miss out!

Don’t miss out!

Date: Friday, March 21, 2025

Date: Friday, March 21, 2025 Time: 5:00 PM – 9:00 PM

Time: 5:00 PM – 9:00 PM Location: The Pavilion at Avalon Park, 13401 Tanja King Blvd, Orlando, FL 32828

Location: The Pavilion at Avalon Park, 13401 Tanja King Blvd, Orlando, FL 32828